Introduction

As Farringdon provides a wide range of services it may from time to time have interests that conflict with its clients’ interests or with the duties that it owes to its clients.

As a holder of a capital markets services licence in Singapore, Farringdon should, in a manner commensurate with the nature, scale and complexity of its business, ensure effective controls to mitigate potential conflicts of interest that may arise from its operations.

An actual, potential, or perceived conflict of interest can arise where any of Farringdon’s employees are subject to influences which might adversely affect decision-making or outcomes while conducting business. A conflict of interest can also be due to the competition of legitimate influences such as acting for multiple customers or clients, or the presence of harmful ones such as personal gain.

Conflicts of interest generally fit into one of various categories:

- Conflicts of interests between Farringdon (including its managers and employees or any person directly or indirectly linked to them by control) and a client of the firm;

- Conflicts of interests between one client and another client; that arise or may arise in the course of the Farringdon providing services to both clients;

- Conflicts of interest arising out of the relationship between Farringdon and the various institutions it engages in the course of providing services to its clients

- Conflicts of Interest between Farringdon and its employees

- Conflicts of interest arising out of the relationship between Farringdon and its affiliates or related companies

Assessment of Conflicts

Conflicts of Interest between Farringdon and its clients

The assessment criteria here would be whether the company or its employees:

- Is likely to make a financial gain (or avoid a loss) at the expense of the client

- Has an interest in the outcome or service provided to the client that is contrary to the client’s interest in the outcome

- Carries on the same business as the client

- Receives an inducement from a person other than the client in relation to the service offered to the client other than a reasonable commission or fee for that service.

Conflicts of Interests between clients

These arise due to potential different interests between clients and may lead to a situation where there is an incentive to favour one client over the other.

While the risk is low given the nature of each bespoke managed portfolios that the firm takes care of, this will continue to be reviewed each time new clients (especially larger institutional type mandates) are onboarded to ensure there is no conflicts with other existing clients.

Client’s interests internally within the firm will continue to be well represented through their advisers or relationship managers and the firm will ensure equal access to all suitable investment opportunities across clients.

Conflicts of interest arising out of the relationship between Farringdon and the various institutions it engages in the course of providing services to its clients

Each of the following relationships will be reviewed during each year’s risk assessments for any potential conflicts of interest that may arise.

- Introducers Agreements and Referral Partners

- Fund Managers where distribution agreements are in place

- All custodial relationships

- Outsourced service providers

- Overseas subsidiaries, related companies or affiliates

Conflicts between Farringdon and its employees

It is important to realise that Conflicts of Interest may be generated by employee’s interests outside of the company. Conflicts between Farringdon and its employees may arise due to:

- staff may have interests in relevant external third party or ownership of interests in other companies

- staff have interests in investments in equities or other such affectable instruments.

- working for other Farringdon companies, or any other additional third-party employment or directorships

- memberships in political bodies or associations or involvement in other public affairs

As part of reviewing the above, special focus will be on instances where staff have a direct or indirect interest in the transactions or dealings that the company enters or stand to benefit from the same.

In all instances the instances listed, staff will be responsible for reporting such Conflicts of interests and identification of such relationships will be part of ongoing training.

Conflicts of interest arising out of the relationship between Farringdon and its affiliates or related companies

Conflicts of Interest may arise because of being part of a group of related companies. Where shared resources or outsourced services between group companies may have any conflicts with respective clients’ interests.

On an ongoing basis continued review of the appropriate scope of interaction between the various offices is done. For example, core client management activities such as onboarding, client advise, dealing all remain at respective company levels while some company level resources such as research and IT resources can be shared.

Defined Reporting

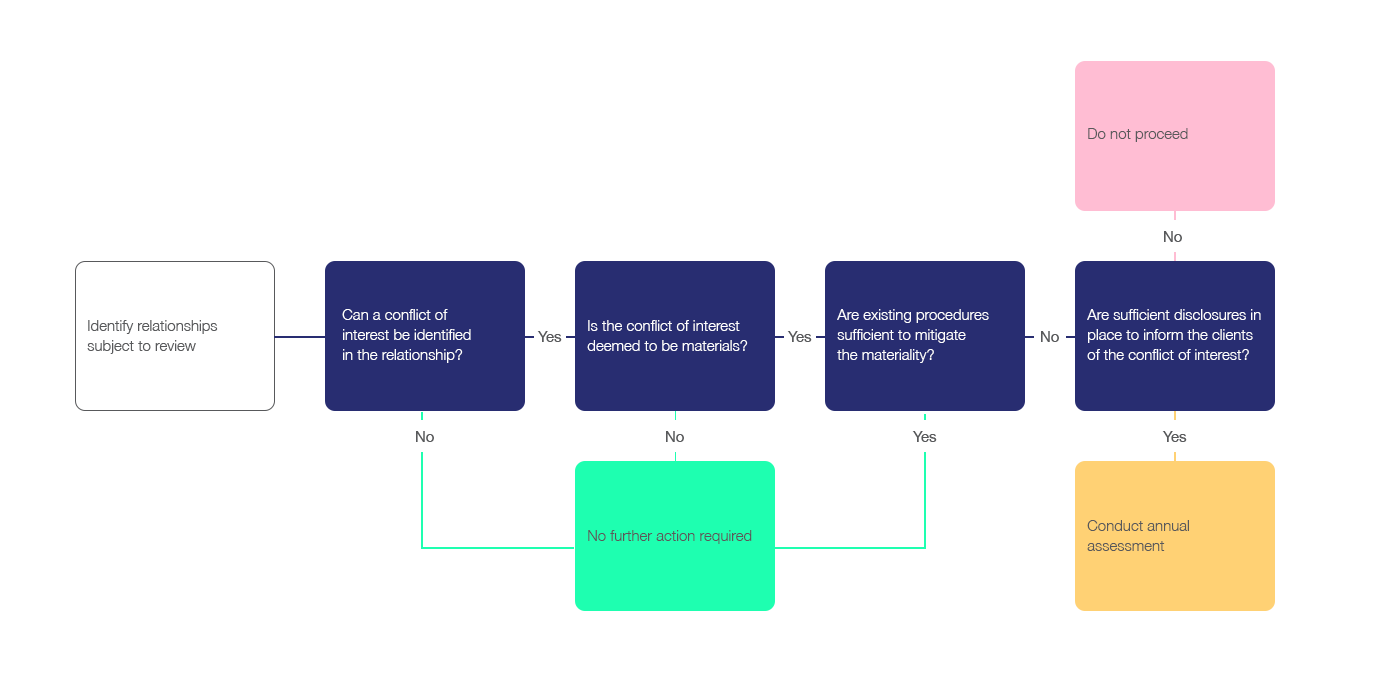

All reporting will be made to the Risk Officer who will be responsible for the assessment of any categorised risk using the following risk-based matrix.

Register

A register will be maintained by the risk officer including all assessments carried out as well as a list of ongoing assessment to be carried out.

Disclosures

Where conflicts of interest are deemed to potentially arise the Risk Officer will ascertain if sufficient disclosures are in place to reasonably inform clients of the factors arising from the relationship between the parties.

Instances where insufficient existing disclosures are in place the Risk Officer may refer the matter to the Ethics Committee to make a bespoke disclosure to the client regarding the conflict of interest to proceed.

Training

Training of identification and mitigation of Conflicts of Interest will be part of representatives annual training.